Joe Biden will be the next President of the United States; Kamala Harris will make history as the country’s first Black, Indian-American, and woman Vice President; Republicans will likely maintain control of the U.S. Senate; and while having lost seats, Democrats will maintain their majority in the U.S. House of Representatives.

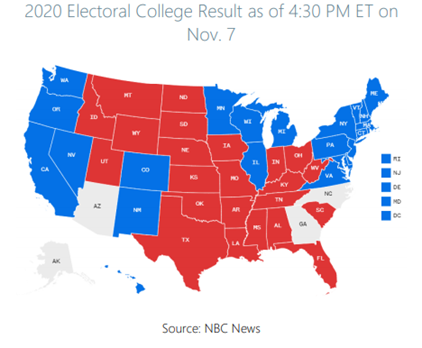

If the final tally holds in the handful of states that will have recounts, Biden may win as many as 306 electoral votes, which will be equal to the same margin of Trump's victory in 2016.

The country entered this election divided and remains even more so. Democrats won the White House, and voters will likely see Republicans maintain control of the Senate following two runoffs in Georgia on January 5.

While Trump was not re-elected, his defeat reaffirmed that his narrow 2016 victory was not a one-off event but rather a deeply embedded reality of current American politics and a reflection of the U.S., rather than the cause of its divisions.

Biden’s victory is a continuation of a long-running trend: in seven out of the last eight elections the country has voted for change, regardless of which party is in power.

While Congress will likely be split between a Republican Senate and Democratic House, many states will have clear partisan control: Ballotpedia projects that in 38 states, the Governor and control of the state legislature will be in the hands of one party (23 Republican and 15 Democrat).

On a national and state-by-state level, most polls did not accurately reflect the outcome of the election.

Biden’s Path to Victory

Based on NBC News’s projection as of 4:30 PM EST today, Biden may win as many as 306 electoral votes.

The Biden/Harris ticket carried all the states that Clinton won in 2016 while also picking up Michigan, Pennsylvania, and Wisconsin. Biden will also pick up Arizona and Georgia if he maintains his current leads.

Entrenched Political Beliefs

Despite the worst pandemic in over 100 years, the most severe economic downturn since the Great Depression and social strife since the 1960s, the vast majority of the country knew who they were going to support before campaigning even began, according to an Associated Press post-election survey.

Political predispositions are so strong that a record amount of campaign spending did not have a measurable impact on swaying American voters. According to the Center for Responsive Politics, a record $14 billion was spent in this election cycle, including $6.6 billion in the presidential contest, which towers over the $2.4 billion spent in the 2016 campaign. This extended to Congress, which saw eight of the ten most expensive Senate campaigns in history, as of mid-October.

In an election cycle that shattered all spending records, the partisan movement was minimal beyond shifts in the Electoral College:

- While the results in the two Georgia run-offs are not yet known, Democrats have thus far made a net gain of one Senate seat, which by itself would not change the overall partisan control of the chamber

- At least 10 seats shifted parties in the House of Representatives

- Only one governorship changed parties, with a Republican pick up in Montana

- No net change in party control of state legislatures if the Democrats win the state house and senate in Arizona.

Historic Voter Turnout

The 2020 presidential election will have the highest voter turnout in over 100 years with more than 147 million ballots already counted. It is quite likely that there will be more than 160 million votes, far surpassing the nearly 139 million people who voted in 2016. The Washington Post projects that when all the votes have been counted, 66.4% of the voting-eligible population will have cast a ballot in this year's election.

Biden’s 74 million votes is now the highest in American history, far surpassing the record 69.5 million people who voted for President Obama in 2008. If Biden maintains his current leads, he will be the first Democratic candidate for President to win Georgia since 1992 and the first Democratic candidate to win Arizona since 1996.

While Trump lost the election, he won at least 10.5% more votes than in 2016. As of 4:30 PM ET, 70 million people (47.7%) voted for Trump in this election—7 million more than his 2016 vote total.

Notably, more than 101 million people voted early or by mail.

The Demographic and Geographic Groups That Elected Biden

According to the Associated Press post-election survey, the groups who most strongly supported Biden and powered his victory were women (+11 points), young voters (+25), Blacks (+82), Hispanics (+28), educated voters (+14 ), suburbanites (+10), and Independent voters (+14).

Biden was also able to reduce the margins that Clinton lost with non-college educated white women and men as well as narrow the margins from 2016 in small towns and rural areas.

However, Trump was able to keep the election close by significantly increasing turnout to 61% of non-college graduates. He was also able to reduce the margin of expected losses in suburban areas as well as with senior voters.

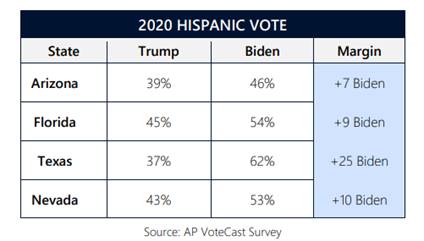

The most significant change that could have a long-lasting impact in American politics was Republican’s unexpected strength with Hispanic voters, the fastest growing group of voters in the country. Trump gained 35% of the Hispanic vote, which was a 7% increase from 2016.

In the end, Biden’s strength in suburban and urban areas overcame any of Trump’s gains. However, if Republicans can continue to make inroads in the Hispanic community—as demonstrated most notably with Cuban and Venezuelan Americans in Florida— they will grow their base of support as America’s demographics continue to evolve.

In the post-mortems of the election that will inevitably be conducted by both parties, expect a deep-dive analysis on Hispanic voters and their impact on future elections.

Congressional Elections

Republicans had a very strong showing in congressional races despite being massively outspent and defending as many as ten Senate competitive seats across the country. They are now favored to maintain control of the Senate although they will need to win one of two Georgia runoff elections on January 5 to seal their majority. The GOP currently has a 50-to-48 seat advantage over Democrats going into the runoff.

While runoffs typically favor Republicans, Biden’s narrow win is expected to energize Democrats to aggressively compete in Georgia. These will also become nationalized elections in what is truly now a swing state. Ballots will start to being mailed on November 18. Early voting starts on December 14.

In the House, Republicans gained at least ten seats, contrary to predictions that they would lose 10-15 seats. The Democrats are projected to have a majority of at least seven seats, which would be the narrowest margin of control by either party in 18 years.

Republicans also showed surprising resilience in swing states and won a number of seats that they lost in the 2018 Democratic sweep of the House. Their strong support with Hispanic voters was instrumental in flipping two Democrat-held seats in Florida, while defending at least five seats that were vulnerable in Texas.

Notably, Republicans will now have a record number of women in the new Congress. Republican women defeated a majority of their Democrat-held seats and will have a minimum of 13 new female members in the House.

Three factors contributed to Republicans’ success:

-

Justice Amy Coney Barrett’s appointment had the effect of nationalizing the Senate elections. Republicans were defending ten vulnerable seats in red states, and the Supreme Court confirmation helped to build energy and turnout for the GOP incumbents.

-

Trump’s repetitive attempts to associate Democrats with socialism and his heavy emphasis on law and order became effective arguments to maintain support for Republican candidates and turn out voters on Election Day.

-

Trump’s second debate performance was strong enough to help bring drifting Republicans back into the fold.

Potential Legal Issues

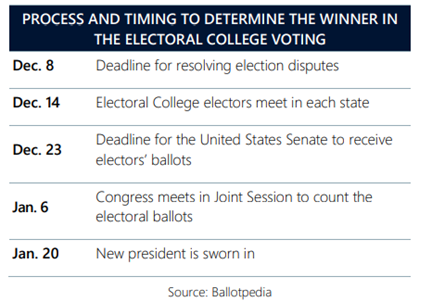

Significant attention will be placed on potential legal challenges to the electoral outcomes in the coming days and weeks. President Trump has vowed to take an aggressive stance on filing legal challenges over the counting process in several states.

While a number of cases have been tossed out or resolved, the Trump campaign’s strategy is to use the courts to challenge the electoral process. The Trump campaign has filed several lawsuits and more are expected. As such, it is important to separate the signal from the noise when thinking about forthcoming legal activity.

- Recounts. These are fairly common, and in some cases, they are actually mandated by state law if the margin between candidates is small enough. In others, candidates can request a recount. The question to ask is whether a recount will produce results that will have a meaningful impact on the margin of victory in a given state.

- Contests over absentee ballots. Some states have segregated some late-arriving absentee ballots, for example, in case there are questions or challenges.

- Other contests. Expect a variety of other legal theories and claims advanced, many of which are less specific―and unsubstantiated―accusations of “voter fraud.” The courts have already struck down some of these claims but expect the Trump campaign to continue to pursue legal avenues to make its case that the electoral results are suspect.

The legal process will likely take some time to sort out, and there is no benefit for elected officials or businesses to either comment on or get ahead of the process. Every vote can and should be counted and this process will take time, so patience will be the watchword. States need to certify their elections by early December, consistent with the chart below.

Now Until Inauguration Day

There are 78 days between Election Day and the inauguration of the new president. This is one of the longest transition periods of any political system. The extent to which Trump continues to litigate and contest the election will likely dictate whether there is a tumultuous transition.

The transition will be influenced by three main factors:

- The extent to which an unpredictable Trump uses this time to continue to advance his policy priorities by executive action.

- A surge in coronavirus cases and deaths leading to additional shutdowns, mandates, and more economic turmoil.

- Demands for economic stimulus if the economy begins to deteriorate further.

While it is unclear how the Trump administration will handle the transition of power, there is no question that the country is headed into a worse phase of the pandemic. As a result, Americans will soon feel increasing economic pressures against the backdrop of political dysfunction as winter sets in.

Any idea of big, bold economic recovery plans to respond to the ongoing coronavirus pandemic are likely moot. Those expectations will need to be moderated by the fact that they now need to pass a likely Republican-led Senate.

It is also possible Congress passes a temporary aid package during the lame duck session. And if that is the case, the debate will quickly turn to whether or not Trump signs it into law.

Regardless of what happens between now and Inauguration Day, President-elect Biden will inherit a deeply divided nation still in the grips of a pandemic and dealing with the economic fallout.

A Biden/Harris Administration

While it is too early to speculate on the detailed policies of a Biden/Harris administration, look for early signals based on the appointments the President-elect makes to his White House staff and Cabinet. Three characteristics will define the Biden/Harris administration:

- Experienced aides. With over five decades in politics, Biden has assembled a seasoned group of loyal advisors and aides to fill appointments to the senior roles in the West Wing. And given the multiple crises on multiple fronts, a Biden/Harris administration will prioritize expertise to meet these challenges.

- Confirmable. Likely Republican control of the Senate confirmation process will be a moderating force on Biden’s appointees―to the dismay of progressives who helped elect Biden.

- Diverse. Biden has committed to a government that looks like America. He is expected to have the most diverse administration in history and is likely to pursue racial and gender parity as he makes appointments.

As when Biden took office as Vice President in 2008, the first priority for his new administration will be an economic aid package commensurate to the crisis caused by the pandemic. The size and specifics of this package will offer insight into the Biden/Harris administration’s priorities and be the first signal of the working relationship between the Biden/Harris administration and Senate Majority Leader Mitch McConnell.

Biden’s instinct to work across party lines may become his defining characteristic as president. Despite pressure to override Republican opposition to his agenda―and pass many of his priorities via Executive Order as Presidents Obama and Trump favored when dealing with a divided Congress―Biden may choose to engage substantively and use his experience in Washington and statesmanship to work across party lines in an effort to return to normalcy.

Policy Implications

A divided government will present challenges for a Biden/Harris administration. A likely Republican controlled Senate will impact how Biden organizes government, how policy is enacted, and how politics is conducted in America.

On matters requiring legislative action—fiscal stimulus, energy, health care, tax policy, and new infrastructure spending—a Republican senate will be a check on the ambitions expressed during Biden’s campaign. Where executive authority is meaningful—COVID-19 response, the environment and climate change, and foreign policy—Biden will have more leeway since there will be less interference. This complexity, and the complicated mix of governance structure and policy issues, will require careful navigation across a broad range of issues.

Policy Overviews