The investor landscape is undergoing fundamental changes.

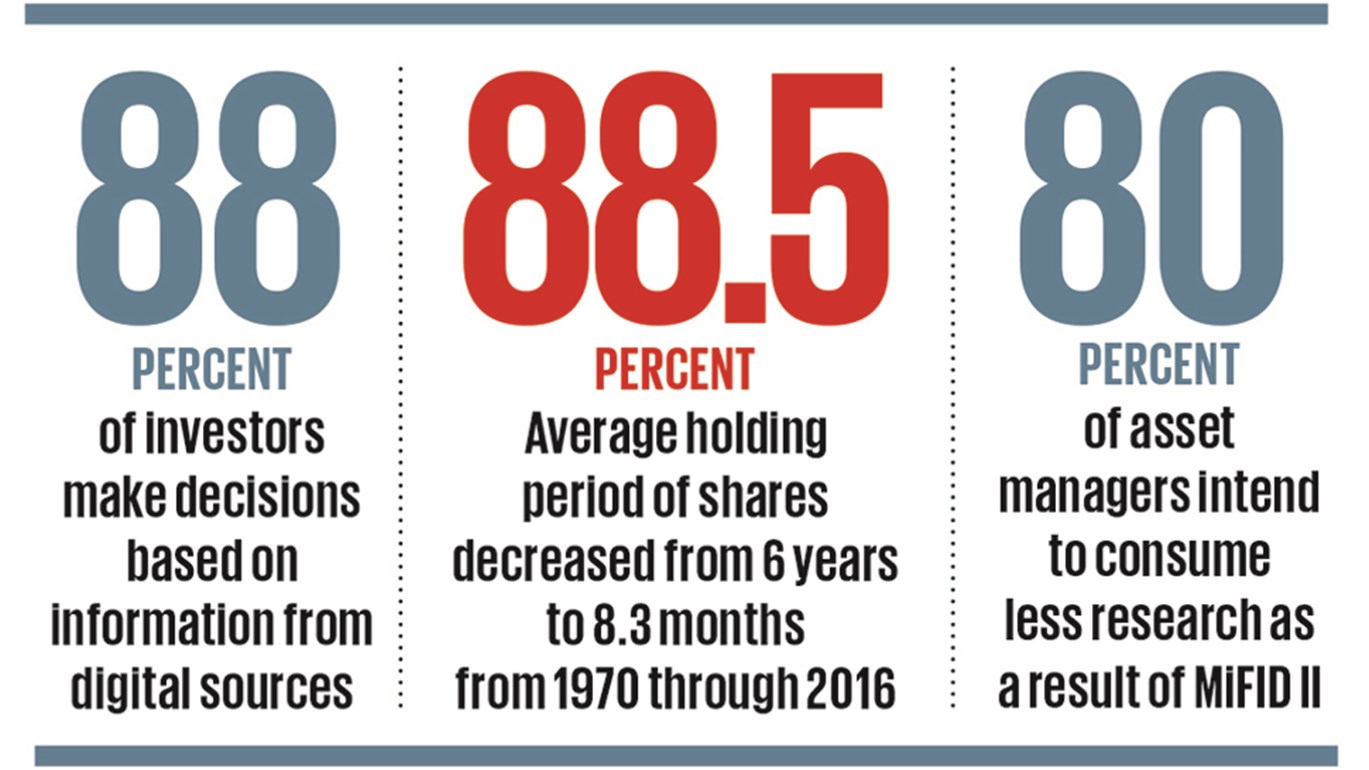

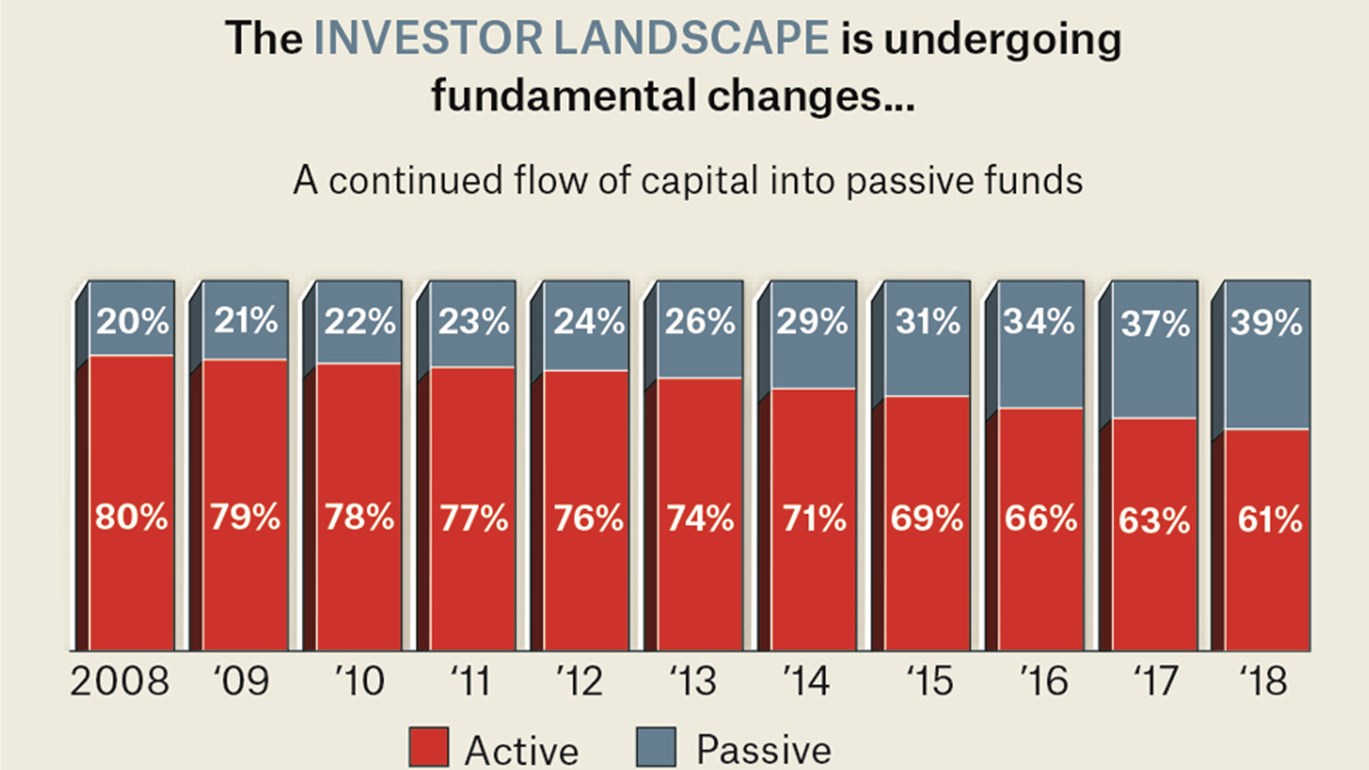

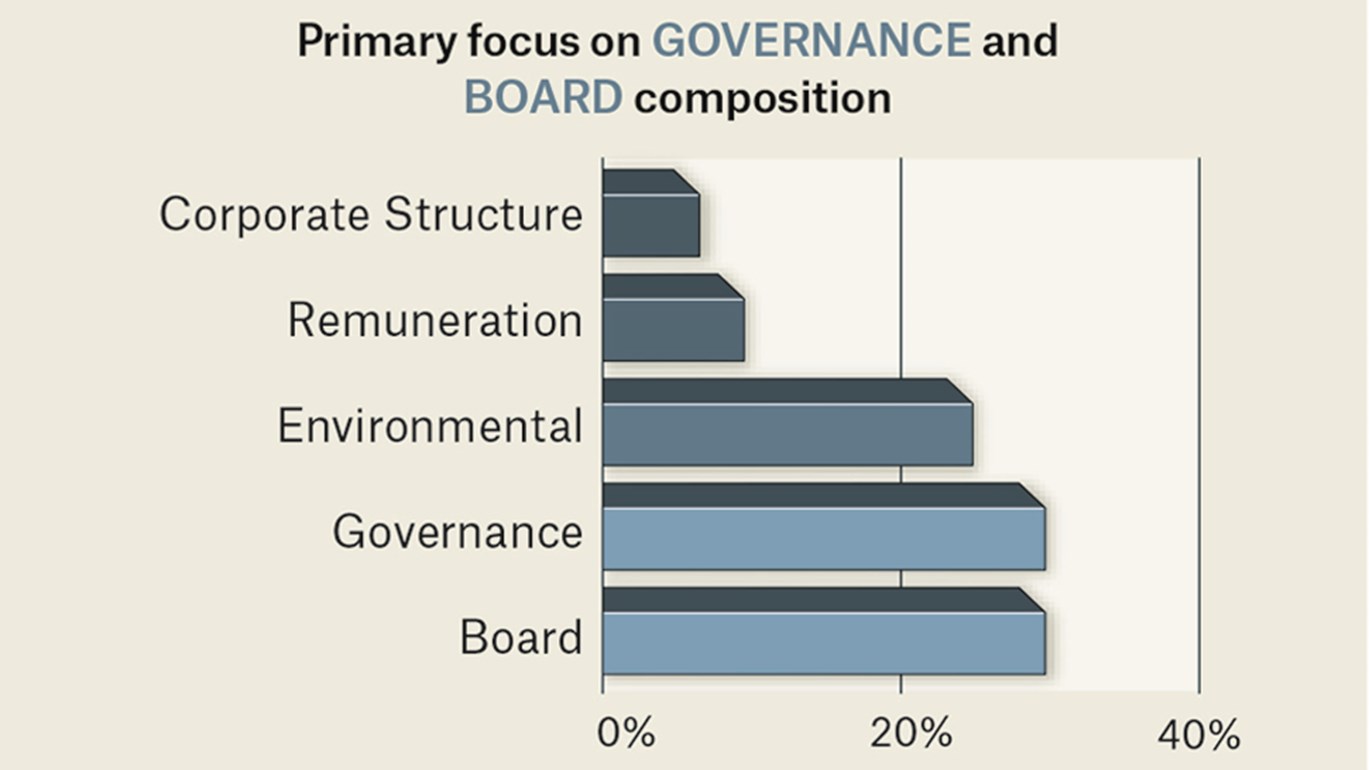

Between 2008 and 2018, the amount of assets in passively managed index funds nearly doubled, and at the current pace there will be more money in passive funds than in active funds by 2024. Accompanying that shift in shareholder registers is one in investor behavior. Passive funds are increasingly using their voices—and their votes—to advance their agendas. Engaged long-only shareholders are now launching as many campaign demands upon companies as traditional activist hedge funds, focusing on a company’s board and its governance. As the makeup and priorities of investors evolve, so does the approach for communicating with them—changing from a quarterly or annual exercise managed by Investor Relations to an ongoing initiative that demands participation from senior management and independent directors. The core tenets of a robust investor engagement program can now be supplemented with innovative digital communications, reaching investors and analysts with greater precision and regularity than ever before.