Key Finding 1: Remote working drove digital acceleration

It’s become a cliché: COVID changed everything. Around the world, we are all adapting to another new normal as restrictions ease and we reintroduce ourselves to friends and colleagues.

Institutional investors were no less affected. 73% said they had to work in a different location as a result of the pandemic, and, as a result, were reliant on digital tools to connect and collaborate.

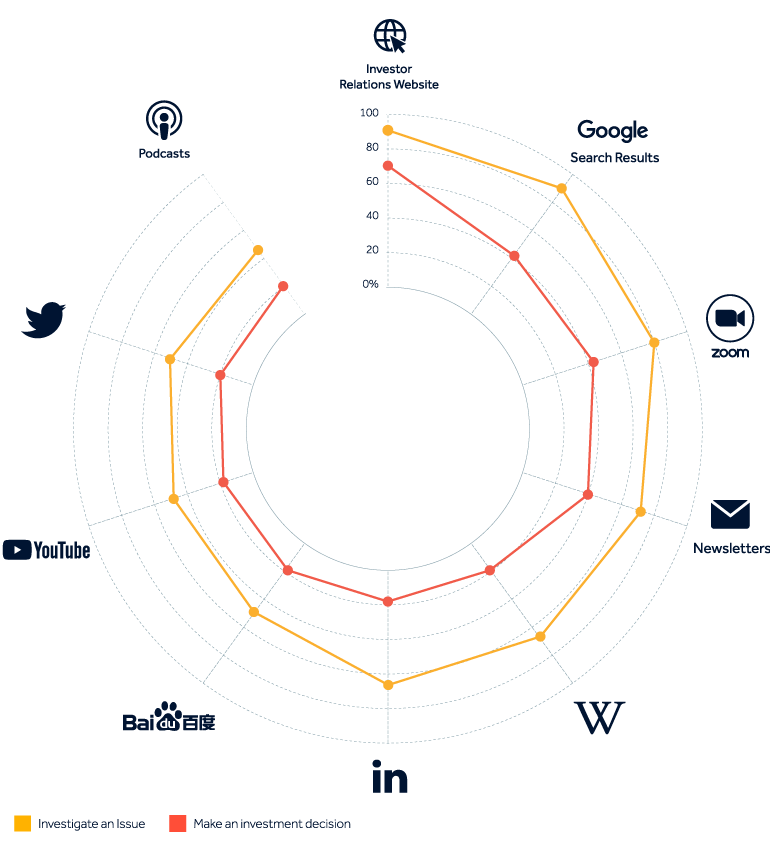

That enforced behavior helped drive big increases in their use of digital sources for information. Use of e-mail newsletters, LinkedIn and most notably, YouTube, all grew dramatically. That means investors are consuming and sharing more rich media content than ever before.

A more digitally-reliant investment community made online and social media sources even more central to investment decision-making. In 2020, digital sources powered more trading decisions and investment recommendations than ever before.

Key Finding 2: Company IR Pages are the Most Used & Most Trusted Source of Information

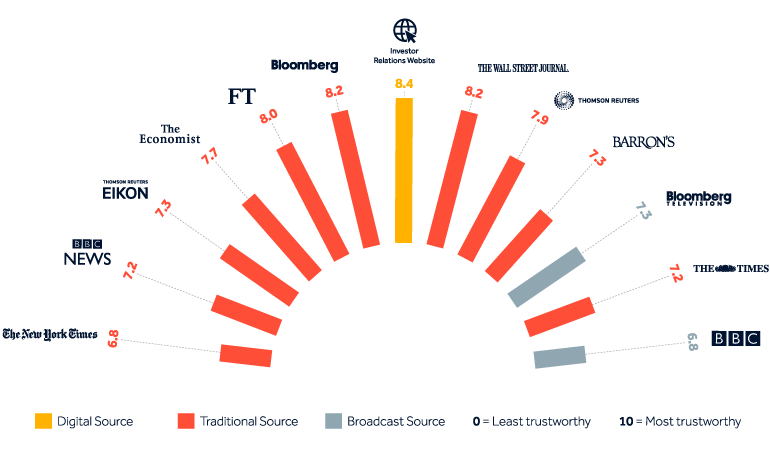

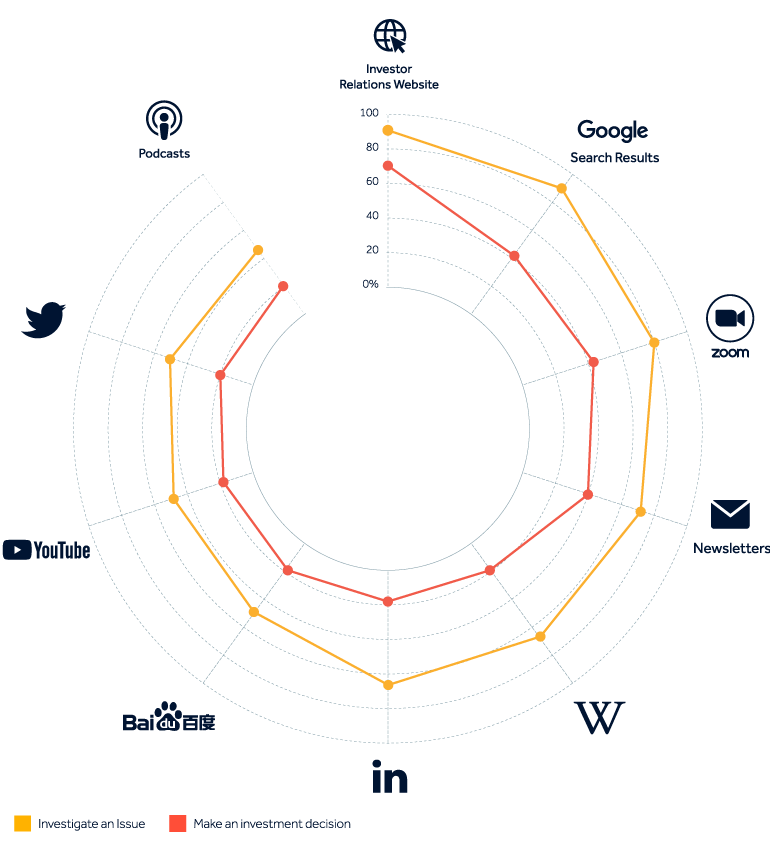

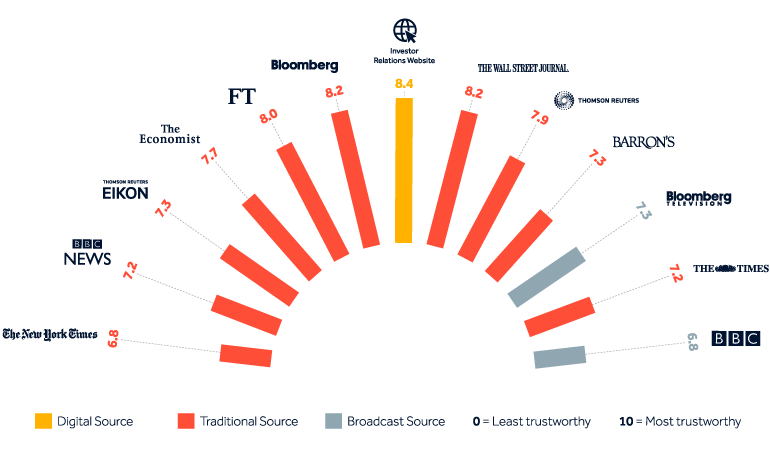

Included in the survey for the first time this year, company-provided investor relations websites emerged as the most used and most trusted sources of information for investors. IR websites weren’t just the top digital source. They were the most used and trusted of all of the sources that we tested.

92% of investors report using the investor relations section of a company’s website to investigate an issue. And 72% say they have made an investment decision based on something they learned there.

On trust, IR websites topped Bloomberg, the FT, and all other traditional news sources.

This presents a significant opportunity for companies looking to do a better job connecting with their largest investors: IR sites have not kept up with the furious pace of change in communications that has played out over the last decade.

Companies should review their IR sites with an eye towards providing richer content and a more personalized experience, targeting their visitors interests more effectively, and providing a steady supply of relevant material.

Key Finding 3: Reddit Excitement Drove Curiosity and Hold the Potential for Real Change

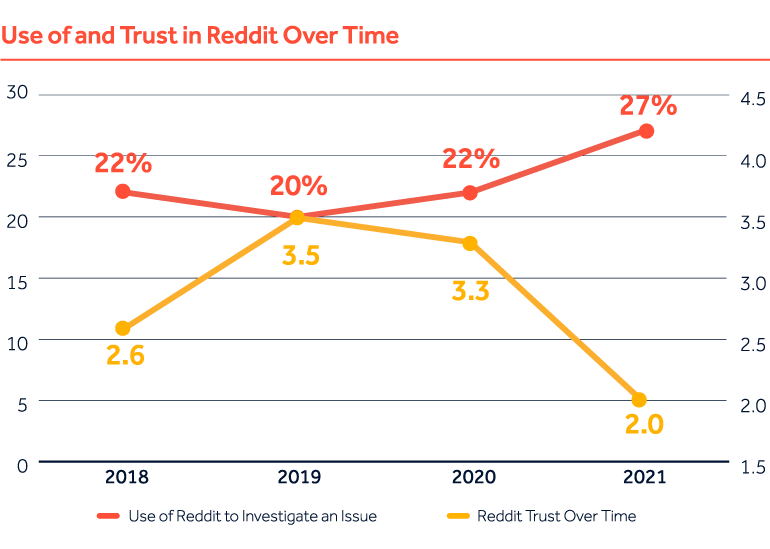

The Reddit community r/WallStreetBets captured the investment world’s attention in January and February, as they collaborated to squeeze short sellers and drive up the share prices for a range of stocks, most notably retailer GameStop.

We conducted a follow-up survey among institutional investors in the US, UK and Canada in February following the initial GameStop activity to assess their views.

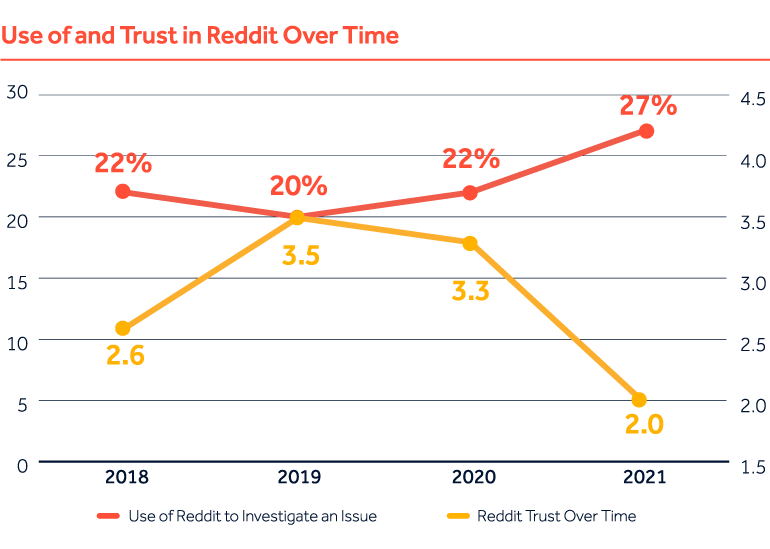

While Reddit usage increased 5 points since our primary survey November, trust in the platform declined from a mean score of 3.3 out of 10 to a new low of 2.0. Meanwhile, use of r/ WallStreetBets was up 6 points, but there was no corresponding increase for other Reddit forums like r/personalfinance or r/investing.

54% of respondents scored Reddit either a 1 or a zero on trust, compared to only 27% in November. Those figures make Reddit the least trusted source we tested.

Nevertheless, 1 in 5 institutional investors said that they made a trade, changed a recommendation or altered a position as a result of activity originating in r/WallStreetBets. And younger investors were more likely to see the story as significant and a precursor of lasting changes.

Key Finding #4: Demand for Alternative Sources Continues to Grow

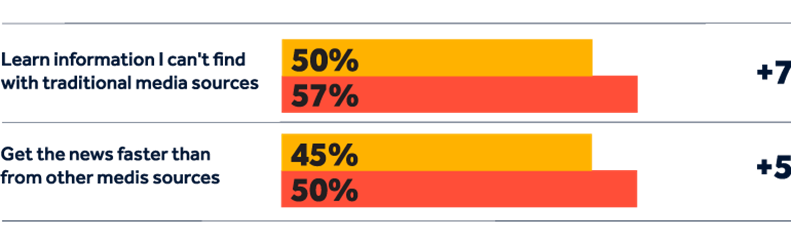

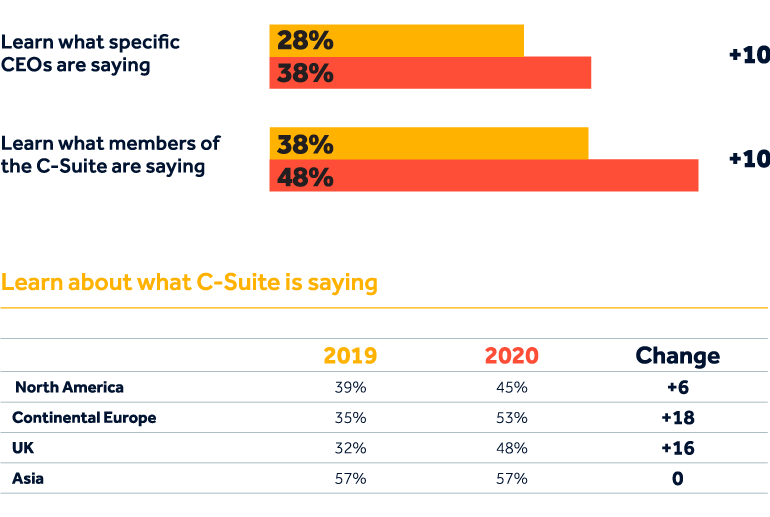

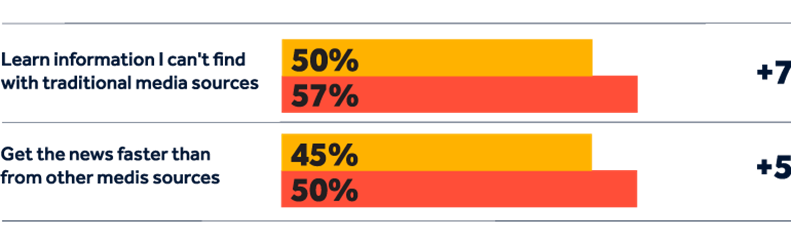

Investor desire for alternative information sources grew by 7 points in 2020, with 57% now saying they use digital sources as alternatives to traditional media. The biggest increases were in Europe and Asia, where 60% and 64% respectively now rely on digital sources to learn information they can’t find in traditional media. That’s an increase of 13 points in both regions over last year. They also value digital sources for their speed and as a potential competitive advantage.

Key Finding 5: Leadership can no longer sit on the sidelines

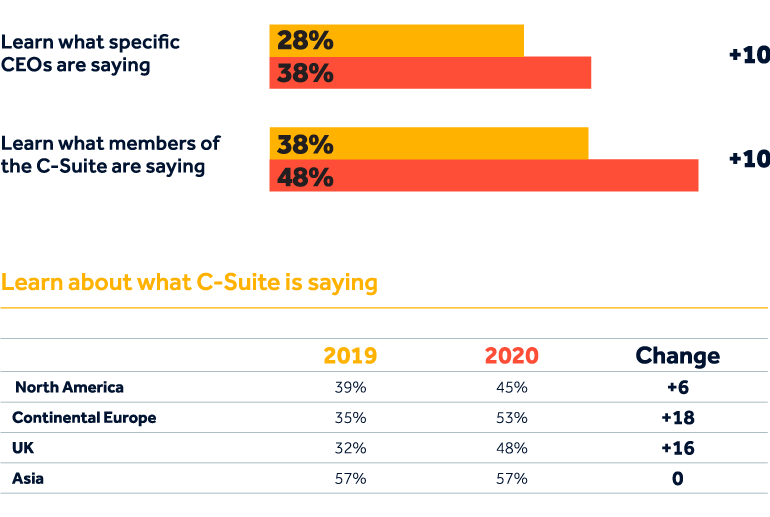

Investors want and expect to hear from CEOs via digital and social media sources. Half said that they specifically use digital sources to hear from the CEO and c-suite. And this expectation accelerated in 2020, especially in Europe and the UK. 38% said that they use digital sources to learn what specifics CEOs are saying. That increased to 48% for the whole c-suite.