Activists are posing bolder, smarter challenges, says Brunswick’s Radina Russell

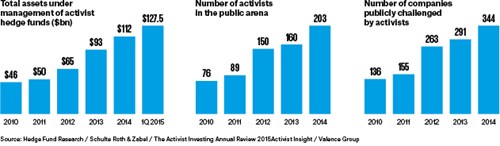

Activist investors are driving fundamental change in boardrooms across the US, and that pressure is increasing dramatically. The number of activists has more than doubled since 2010, with upstarts building on the success of the pioneers. The number of companies targeted increased 18 percent between 2013 and 2014.

As activism has grown, campaigns have become both more sophisticated and more audacious. Where activists once sought a simple return of more cash to shareholders, they are increasingly calling for new board members as a way to drive operational and structural change. With greater assets under management, they can take on larger targets. In 2014, there were 21 campaigns against companies with a market capitalization above $10 billion; in the first half of 2015 alone, there were 18.

Along with the shift in motivations and approaches, the success rate of activist campaigns has increased. In 2014, activists won, partially won or reached a settlement in 73 percent of the campaigns they launched – a staggering increase over the 53 percent “success” rate in 2010.

Given the changes, companies would be smart to be equally savvy and prepared for the challenges that could come.

Radina Russell, a Brunswick Director, leads the activist preparedness practice in the New York office.