While politicians debate the reality of climate change, a clear consensus for action has emerged in the business world. Brunswick’s Phil Drew and Jordan Bickerton report

Politicians and the media may still be debating climate change, but in the business world there is a clear consensus that action is needed. Many leading investors, prominent business heads and large organizations are answering the call – and taking serious action.

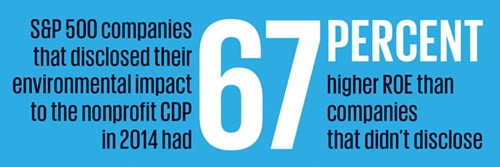

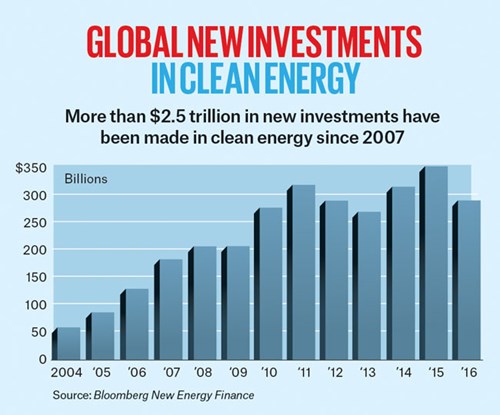

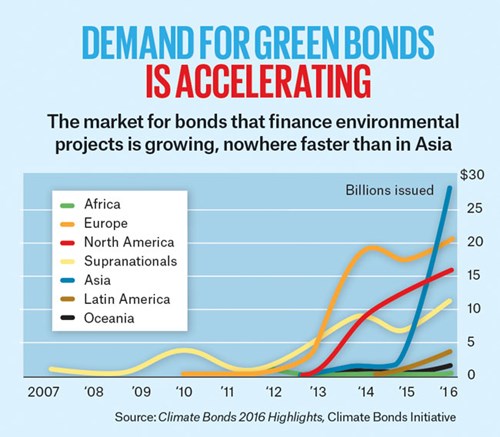

Climate initiatives, renewable energy projects and green bonds now attract hundreds of billions of dollars in investment annually. Far from being an expensive drain on a company’s bottom line, a growing body of data suggests that companies leading the way on climate change tend to outperform their peers financially.

Many are setting their sights even higher, publicly pledging to commit more resources to tackle the problem and become energy neutral themselves.

The following research provides a snapshot of the movement among some of the world’s leading businesses to address climate change today.

It also shows how businesses can become, and already are becoming, leaders in society by taking action to solve a global crisis.