Who is affected?

The directive will apply to all businesses with an annual net turnover surpassing €450 million and with more than 1,000 employees. In addition, the rules will also cover companies from non-EU countries that generate the required turnover figures within the EU, without any employee thresholds in place.

What the CSDDD means for business

While the CSDDD has been in the legislative pipeline for some time, its passing underlines the need for larger companies to develop robust and credible climate transition plans or face potential sanctions or civil liabilities if they fail to meet their due diligence obligations.

This requirement to implement a transition plan is what distinguishes the CSDDD from the rules it builds upon. The directive moves from a duty to disclose plans that have already been enacted to a duty to change strategies and business models in support of the net-zero transition.

This legal requirement for a transition plan can present an opportunity beyond addressing investor and regulatory demands. A transition plan can also aid a company in the development of its core growth story by detailing how it plans to move forward in a world increasingly concerned with reducing greenhouse gas emissions and tackling climate change.

Part of a growing trend

Net-zero transition plans have been subject to increased levels of regulatory scrutiny over the past few years as part of a trend that extends beyond the borders of the EU. The origins of transition plan development began with international industry-led initiatives including the Glasgow Financial Alliance for Net Zero (GFANZ), focusing on financial institutions, and the work of the international Task Force on Climate-related Financial Disclosures (TCFD).

By moving beyond disclosure requirements and toward a legal obligation to implement a more detailed transition plan, the CSDDD has placed the EU at the crest of the global regulatory focus on the topic. Other jurisdictions are also set to mandate credible transition plans. Switzerland will require some companies to detail a transition plan comparable to the country’s climate targets, while the UK is anticipated to adopt the recommendations of its Transition Plan Taskforce into regulation by early 2025.

Achieving net-zero and demonstrating credibility

The focus on credible climate transition plans has gathered momentum due to a simple fact: Declaring net-zero ambitions with goals set years in the future is an entirely different challenge to actually achieving those goals.

Mandatory transition plans require businesses to demonstrate, in detail, how they will achieve their stated transition goals. Without a sufficient level of detail in explaining how these goals will be met, a plan will not be considered truly credible.

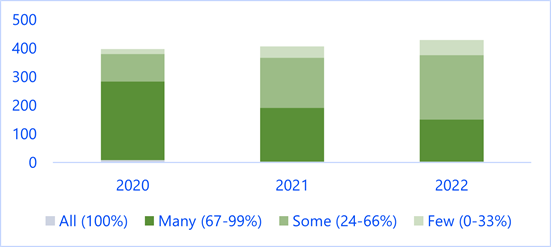

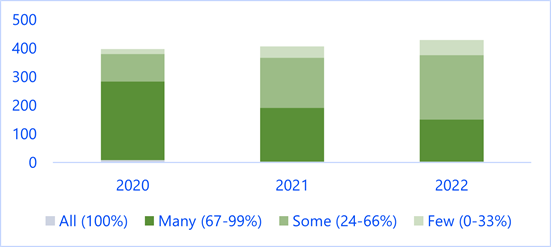

A credibility gap, where companies have a voluntary transition plan in place but do not fully describe how they will achieve their transition goals, is already visible. According to data from CDP, while the overall number of S&P 500 member companies with transition plans has increased since 2022, a greater proportion of those businesses disclosed plans which satisfied only “some” or “few” of the organization’s key indicators.

Figure 1: Proportion of S&P 500 companies disclosing key indicators of a climate transition plan

Source: CDP, Corporate Environmental Action Tracker

Transition plans will become ever more important as more jurisdictions are preparing to make them mandatory, while many of the world’s leading insurance companies and asset managers have already begun to make the presence of a transition plan a core expectation.

Next steps

The CSDDD formalizes the growing expectation that businesses plan and publish a credible net-zero transition plan. To be compliant with the new regulation, while also addressing the demands of investors and other stakeholders, businesses should detail a plan that indicates how they will navigate the material risks of the transition while capturing the significant opportunities it presents.

The creation and publication of a company’s first transition plan requires early and coordinated engagement across a range of stakeholders, including investors, suppliers, clients, trade associations, staff and employee representatives, as well as civil society actors such as relevant NGOs, to ensure the plan’s success. In fact, as part of the legal due diligence obligations, the CSDDD stipulates that companies must consult their stakeholders effectively and transparently. The development of a company's transition plan must be led by the executive team and involve all relevant business divisions. The role of the company’s communications experts is crucial in this process and requires their involvement from the outset.

You can download a copy of this report here.