Themes from the oil and gas majors’ Q4 2023 earnings calls

The oil and gas majors reported results for the fourth quarter that were lower than a year earlier due to energy prices and refining margins declining from prior year highs.

The oil and gas majors reported results for the fourth quarter that were lower than a year earlier due to energy prices and refining margins declining from prior year highs.

The results were typically described as ‘strong’ by the companies, who also emphasized solid operational performance and cashflow generation and their commitment to shareholder returns. Most of the companies delivered results that met or exceeded analysts’ consensus estimates. Management teams reflected on health and safety performance in prepared remarks. They also highlighted how they are leveraging artificial intelligence and digital technologies to drive efficiency and improve the performance of their assets.

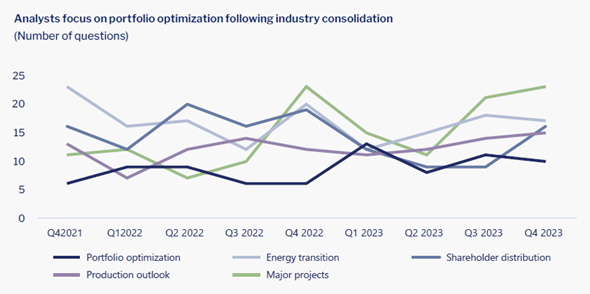

The trend of consolidation in the US shale sector continued into 2024. Portfolio optimization themes featured high on the agenda of analysts during fourth quarter earnings calls. Analysts were interested in the thoughts of the European majors on potential M&A activity following the deals announced by the US majors. Additionally, the analysts asked if companies are open to strengthening exposure to specific geographies or commodity types. Most companies indicated that they are focused on execution of their organic growth pipeline. However, a couple of the majors noted that they remain open to acquisition opportunities.

Disposals also featured prominently in the discussions. Analysts were particularly interested in the confidence that companies have in finding buyers for assets targeted for divestment.

Questions focused on energy transition themes represented 10% of all those raised in fourth quarter earnings calls. Analysts requested additional detail on the projected returns across lower carbon business units. This request is a recurring theme across previous earnings calls. The analysts welcomed the efforts of the majors to improve visibility on financial reporting in this segment. Project economics, particularly in the wind power sector, were the focus of questions from some analysts. Operational matters were also of interest. Companies were invited to comment on their targets for renewable power capacity growth and any barriers to achieving the goals. Further questions spanned a variety of low carbon technologies or fuels, including hydrogen, carbon capture and storage, electric vehicle charging and sustainable aviation fuel, reflecting the different transition strategies of the majors.

Shareholder distributions were also in the spotlight during fourth quarter earnings calls. This theme accounted for 9% of all questions. Management teams emphasized the prioritization of shareholder returns within existing capital allocation frameworks in their prepared remarks. The majors returned a combined $135.3bn to shareholders through dividends and share buybacks in 2023. The analysts asked the majors to comment on their distribution frameworks moving into 2024 and any potential changes to returns strategies. Some companies announced new share buyback programmes with their quarterly results. Management teams faced questions on the use of buybacks over dividends as the preferred way to return cash to shareholders. Analysts also raised questions on the sustainability of returns policies if market conditions deteriorate.

Questions on the production outlook featured prominently in all the earnings calls. The analysts sought clarity on changes to previously communicated plans to gradually decrease oil and gas production beyond 2030. The majors are aiming to grow output or keep it stable in the near-term. In 2023, the majors individually reported oil and gas production growth of between 2% and 9%. The analysts also focused on the possible upside to previous production guidance through the start-up of new projects or the integration of acquired upstream assets. Similarly, there was also interest in the impact of asset divestments on production projections. Further question explored the impact of technology on Permian well productivity.

The majors were asked to provide updates on their major projects. Analysts requested updates on project costs and timelines, and any changes to earlier guidance. There was some discussion of the productivity improvement initiatives that companies have implemented to keep projects on track. However, analysts also wanted to understand the impact of instability in the security and political situation in some countries on project schedules. Additional questions related to significant oil or gas discoveries made by the majors in recent months. Analysts were interested in the key milestones they should follow in the development plans for these projects.

The companies included in this review are BP plc, Chevron Corporation, Eni S.p.A., Equinor ASA, ExxonMobil Corporation, Repsol S.A., Shell plc and TotalEnergies SE.