Financial value is at risk as Chinese companies, in the lead for global M&A, struggle with the reputation of “China Inc.”

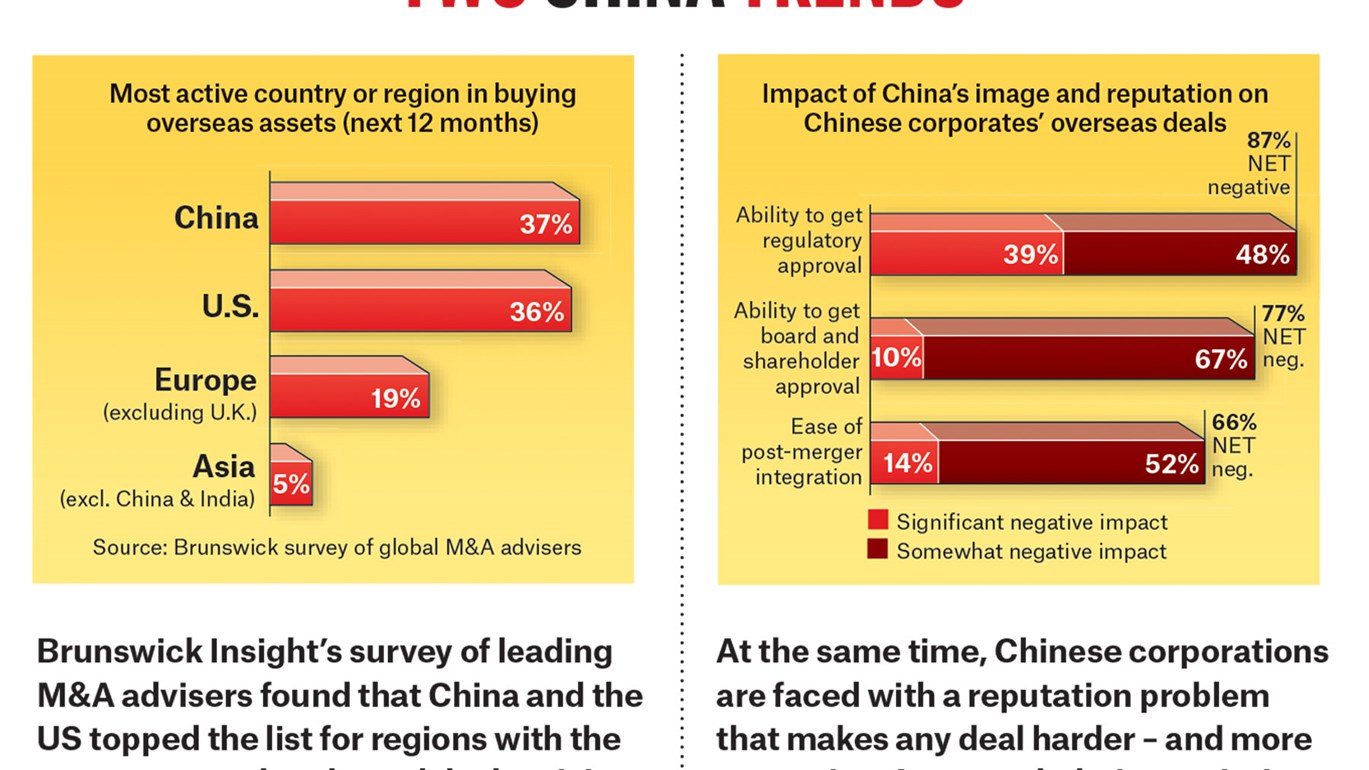

A recent Brunswick survey of senior M&A advisers, along with our “Perspectives” research among the general public – 43,000 people in 26 markets – paints a bleak picture for Chinese corporates. An overwhelming majority of the M&A advisers polled believe reputation has a significant impact on deal costs, both for an acquiring company as well as a target. This impact is particularly acutely felt by Chinese companies seeking to make acquisitions. Their reputation is seen as having a significant negative impact on their ability to get regulatory approval, shareholder approval and their ability to successfully merge after a deal has closed.

As Chinese companies step forward to play a bigger role on the world stage, how can they build the understanding and trust required to make them welcome acquirers overseas – and, in the process, lower their costs of doing business?

Cross-border leader

While many commentators in the past two years, especially those in the West, have been hailing the “death of globalization,” you would not know it by looking at recent trends and future projections in cross-border M&A. Recent Brunswick Insight research among M&A advisers, most of whom are senior lawyers and bankers across North America, Europe and Asia, shows high optimism that 2018 will surpass the solid volumes seen in 2017.

Central to this growth story is China. With rhetoric from the US administration focused around a theme of “America First” and nationalist movements in Europe threatening to gain serious traction in key elections, 2017 was the year that China stepped forward as the new champion of globalization. Speaking at Davos, it was Xi Jinping urging the world’s leaders to remain “committed to developing global free trade and investment” and to “say no to protectionism.”

There are clearly gaps between rhetoric and real action on both sides of the world. However, recent moves by the Chinese administration to open its economy and liberalize new sectors of the economy to inbound investment, as well as its Belt and Road initiative and continued support for specific types of outbound investments, reinforce the country’s positioning as a new leader for globalization.

This shift was recognized by a full third of advisers worldwide in our research, who see China’s Belt and Road policy as a leading factor driving global cross-border M&A, ranking ahead of shareholder activism (27 percent) and US tax policy changes (24 percent). Most advisers still expect China and US outbound M&A to lead the way in 2018.