Market predictions: an uptick in deals and cross-border activities

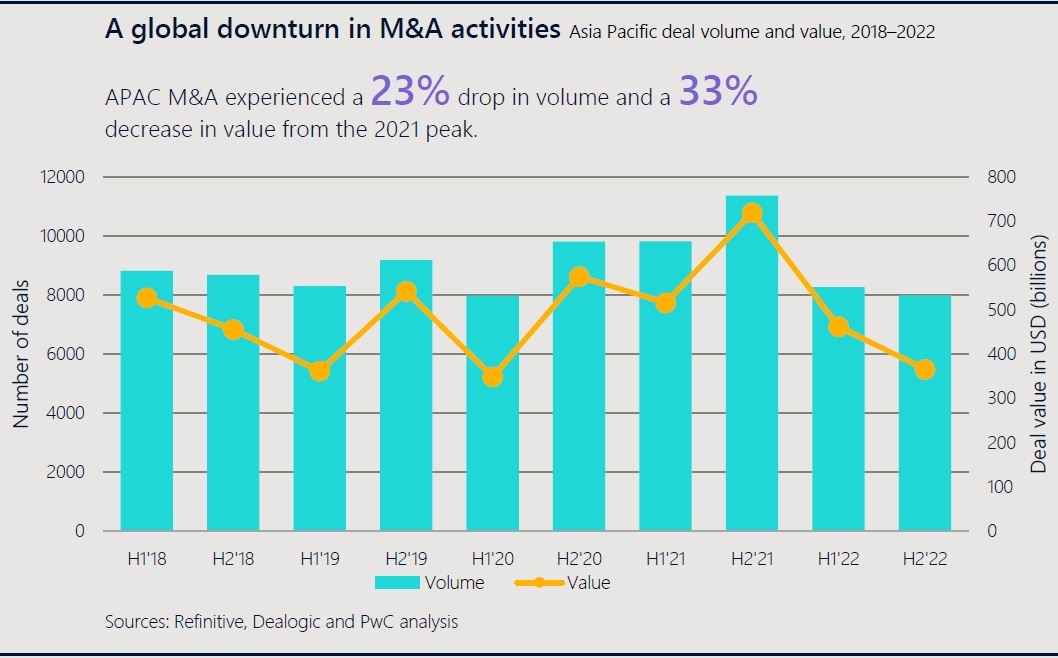

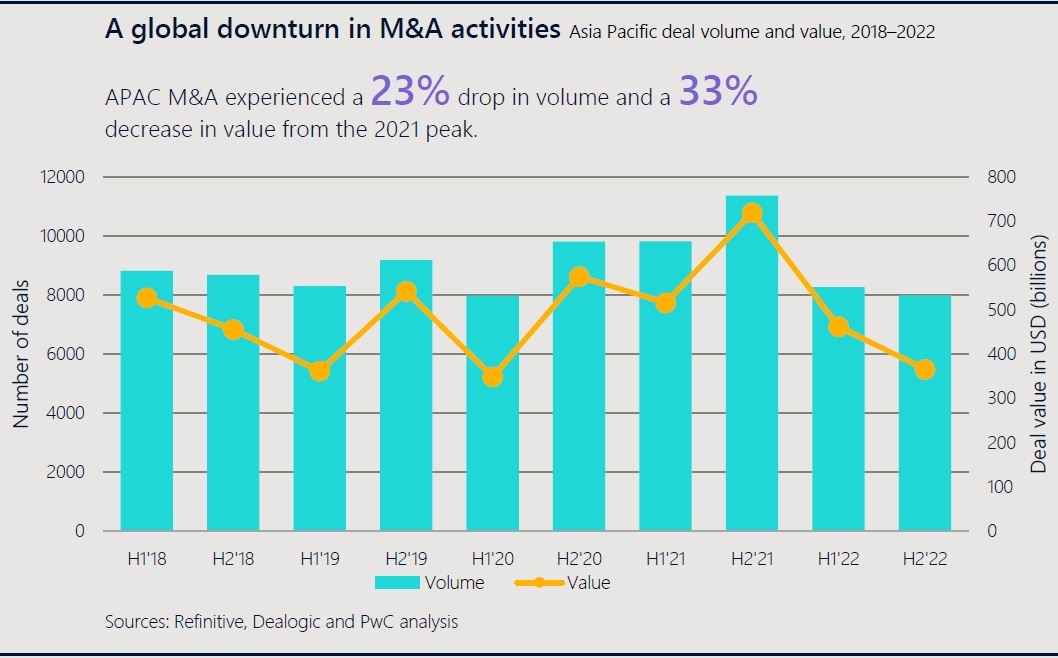

2022 witnessed a global downturn in M&A activities, and Asia Pacific was no exception. The region experienced a 23% drop in volume and a 33% decrease in value from the 2021 peak.

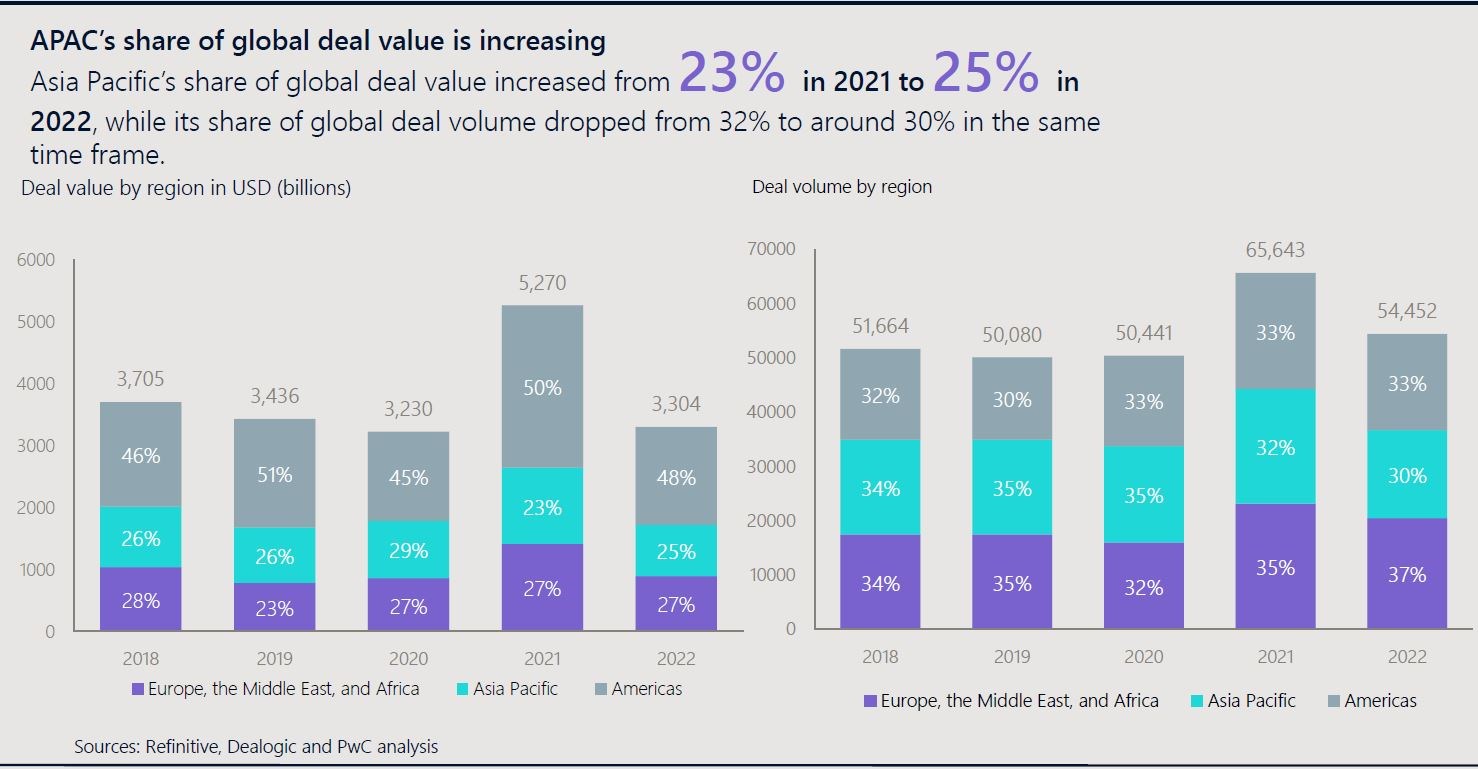

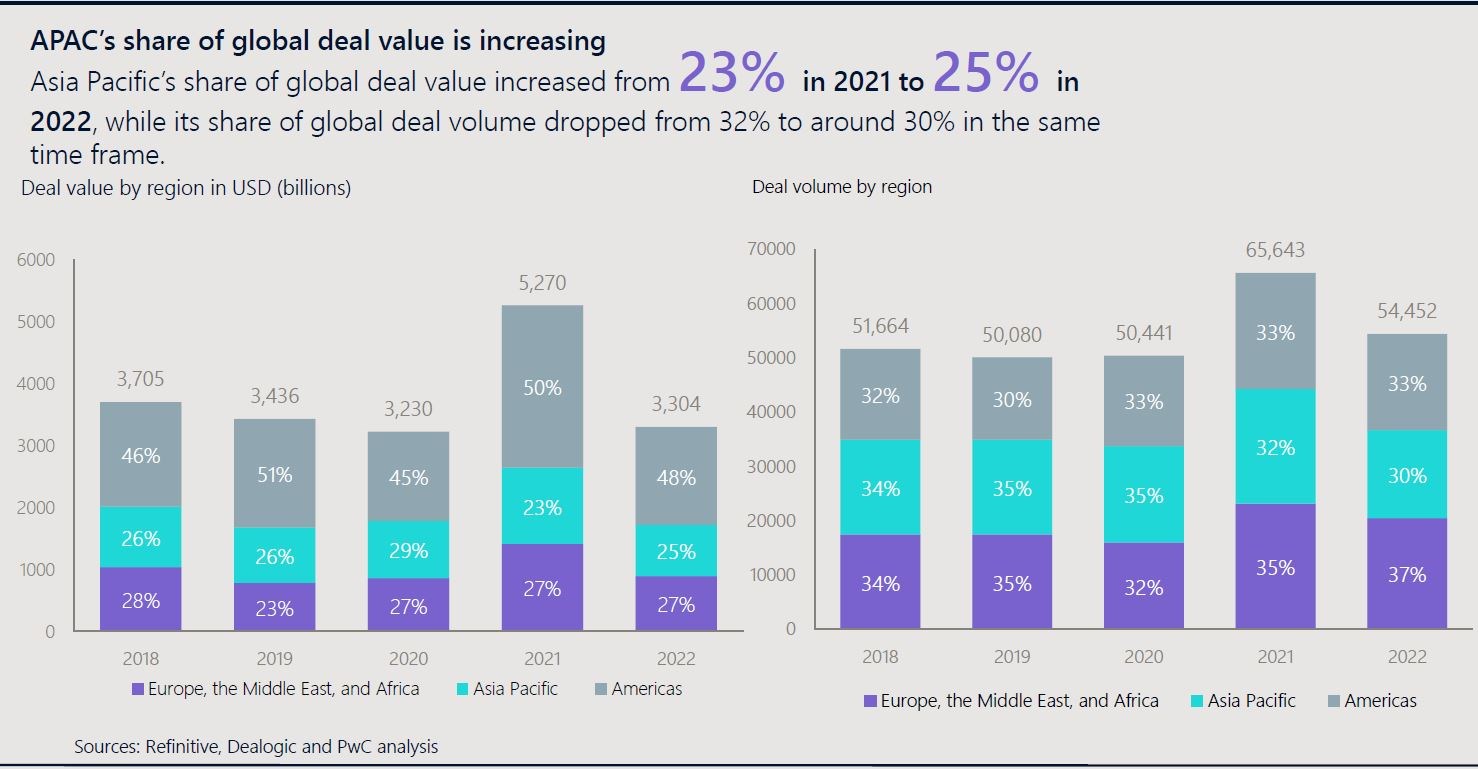

Despite this decline, Asia Pacific’s share of global deal value increased from 23% in 2021 to 25% in 2022, while its share of global deal volume dropped from 32% in 2021 to around 30% in 2022.

M&A in China slowed in 2022 in response to the country’s pandemic-related challenges and weakening demand for exports, resulting in a sharp decline of 46% in deal volume and 35% in value between 2021 and 2022. But it has picked up in 2023 as China has opened up again. India, Japan and Southeast Asian countries are also attracting investment, with India surpassing Japan and South Korea to become the second-largest investment destination in terms of deal values in the region, after China.

Companies in the region are now seeing opportunities to reimagine their businesses, expand globally or acquire technology through cross-border M&A deals.

Market analysts predict a noticeable increase in deal-making activities further into the latter half of 2023, and a significant rise in cross-border activities in the next two years and beyond. In addition to these positive developments, investors and companies will continue to encounter regulatory and geopolitical headwinds.

Assessing regulatory and geopolitical challenges

In recent years, many countries have tightened regulations on foreign investment, particularly in sensitive sectors such as industrials, energy, technology and communication services. For instance, the Committee on Foreign Investment in the United States has broadened its review of foreign investments to include newly formulated national security factors such as supply chain resiliency, US technological leadership, cybersecurity and sensitive data. Similarly, China’s Foreign Investment Law requires foreign investors to undergo national security reviews and imposes restrictions on investment in certain industries. Just last year, China further developed its national security regulatory regime by promulgating measures on cybersecurity review and assessment of cross-border data transfer.

M&A involving cross-border transactions will most likely face significant delays and uncertainties because of these new regulatory challenges. It is critical for companies to conduct a thorough assessment of the regulatory and market landscape in each country they plan to do business in and develop strategies to manage compliance and public opinion and mitigate risk. This requires close coordination between legal, financial and communications teams, and a deep understanding of local laws, regulations and the socioeconomic environment.

Apart from regulatory challenges, geopolitical risks are another major consideration for companies engaging in cross-border M&A. Globally, the war in Ukraine and the ongoing tensions between the US and China pose the most significant risks to the world economy in 2023 and beyond. In Asia Pacific, there are several flashpoints including the potential for conflict in the Taiwan Strait, the South China Sea and the Korean peninsula. These risks can create substantial uncertainty for M&A deals, especially for companies operating in sensitive sectors or with broad exposure to geopolitical risks.

Strategic communications before, during and after transactions

M&A transactions can have a significant impact on a company’s communication strategy, and how a company communicates can in turn impact employee morale, customer loyalty and shareholder value. Here are some key considerations for strategic communications before, during and after an M&A:

Before

- Develop a clear and consistent messaging strategy that explains the benefits of the M&A and addresses any potential concerns. Highlight the benefits of the M&A, such as increased market share or improved product offerings, while also addressing any concerns that stakeholders may have, such as disruption to the industry, changes in business dynamics, job losses or changes in company culture.

- Identify key stakeholders and tailor communication to specific stakeholder groups. This can include government and regulatory bodies, media, employees, customers, business partners and investors. Different stakeholders will have different concerns and questions; develop customized communication strategies and plans to cater to each. The plans should include the timing and frequency of communications, as well as the channels used to communicate.

- Consider partnering with a strategic communications advisor and a PR firm to help develop and execute the communication plan. An experienced strategic communications advisor and a PR firm can help the company develop an effective communication strategy and execute it in a way that resonates with respective stakeholders.

During

- Communicate early and often. Provide regular updates on progress and milestones. This will help build trust and manage expectations.

- When communicating, be clear about the reasons for the M&A and what it means for the company and its stakeholders: The company's leadership should communicate the rationale for the M&A and the expected outcomes to its key stakeholders including employees, customers and investors, among others. The messaging should be clear, concise and consistent across all channels. This will help enhance understanding and gain support.

- Be transparent about any potential risks or challenges. Be upfront about any potential risks or challenges associated with the M&A, such as regulatory hurdles or integration challenges. Transparency will help build confidence and minimize surprises.

- Be prepared to address rumors or negative media coverage: Rumors and negative media coverage can be damaging; have a plan in place for managing potential crises. This could include preparing key messages and spokespeople, monitoring social media and responding quickly to any negative coverage.

After

- Devise a clear integration plan for the two businesses. This should encompass identifying possible barriers and potential areas of conflict and establishing a governance structure and bespoke communications program to ensure a seamless transition. M&A often bring together employees from diverse cultures and backgrounds, which may pose challenges around communication, collaboration and management. Effective communication strategies can help the company address key stakeholder concerns and cultural challenges that commonly arise in cross-border M&A.

- Reiterate the benefits of the M&A: After the M&A is completed, the company should communicate how it has improved the company’s position in the market. This will help build stakeholder confidence.

- Continue to engage with stakeholders. Address any ongoing concerns or questions. This could include regular communication through newsletters, town hall meetings, social media updates, etc.

- Use the M&A as an opportunity to rebrand or refresh image and messaging. This could include updating the company’s logo, website or marketing materials to reflect the new direction of the company.

- Monitor and measure the impact of the communication strategy: Impact can include stakeholder feedback and media coverage. Make adjustments as needed and refine communication strategy for future M&As.

Creating long-term value

The Asia-Pacific region is poised for a surge in M&A activities, propelled by a range of factors such as economic recovery, industry restructuring and regional companies’ desire to drive growth and expand their reach. However, investors and companies must not underestimate the significance of due diligence, effective communication strategies and post-merger integration planning in ensuring a successful outcome. By paying close attention to these factors, companies and investors can maximize the potential benefits of M&A and create long-term value for all stakeholders.

Download a copy of this article here.