Industry issues faced by US banks – but also other sectors

Issue 1: Forward thinking about negative scenarios

Not all banks thought carefully enough about downside scenarios that they could have anticipated in advance, such as sharp rises in interest rates or the speed at which depositors could withdraw money. Similarly, every industry has companies that understand certain risks ahead of time, but don’t model them fully on the grounds that they are less likely to materialize.

Issue 2: Crisis of confidence amid contagion

Some banks suffered from a crisis of confidence that was not justified by their individual balance sheets but occurred as a result of broader turmoil. In an industry crisis, many companies will suffer a frustrating disconnect between their own health and wider industry issues.

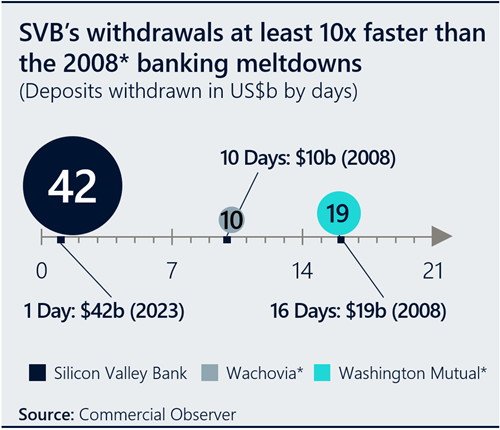

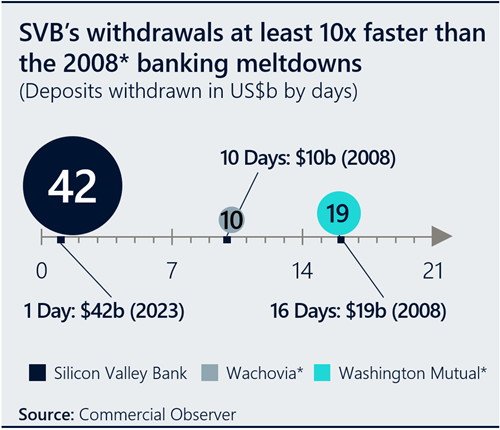

Issue 3: Speed of the digital age

Banks experienced a collective upheaval that was even swifter than the financial crisis of 2008. This was driven partly by enhanced digital infrastructure, such as instant withdrawals of deposits on mobile devices, but also by the experiences of the 2008 crisis and policymakers’ and customers’ readiness to act quickly. In a digital age, companies should be prepared to respond to faster reactions from all their stakeholders and realize that outcomes can be more difficult to control.

Issue 4: Social media speculation

Banks were the subject of fast-moving speculation on social media, creating an underground news cycle and phenomena, like meme stock trading, that proved difficult for institutions to tackle. Shaping social media discussion has now become a feature of every industry crisis.

Issue 5: Reassurance without evidence

In select instances, banks tried to reassure stakeholders to stay calm rather than leading with evidence that showed why they should do so. In industry crises, stakeholders sometimes feel that companies who lead with a stay calm message are doing so because they have no plan or other strengths to offer.

Issue 6: Missing the big picture

When responding to the crisis of confidence in the industry, some banks focused too much on negative specifics (such as deposit numbers and bank run scenarios) and not enough on the more general context or on their broader strengths. Often, companies in industry crises can accelerate attention on smaller hang-ups by not pulling back to the (usually more benign) big picture.

Issue 7: Policy challenges

US banks and their regulators faced policy challenges in containing the broader upheaval in the sector. Industry upheaval is often accompanied by systemic challenges that policymakers cannot solve entirely and may require individual companies to take action, on either the industry’s behalf or their own. In the recent banking turmoil, one key example was providing reassurance over deposits.

Key lessons for an industry crisis

Taking into account the issues above, here are seven lessons that communications professionals can take away from the US banking turmoil when preparing for or managing other industry crises.

Lesson 1: Enhance your scenario planning

Given the speed at which crises now move, it has become even more critical to identify negative scenarios systematically (even unlikely ones), agree on contingency plans with executives, and update those scenario plans in line with developments. During a crisis, there will not be sufficient time to find the

best solutions and get buy-in from key decisionmakers.

Lesson 2: Develop a resilient narrative

It is important to tell a wider story about your organization that convincingly sets any crisis in context, rather than focusing comments too much on specific negative details and scenarios. Ensure your executives are comfortable telling that story and that you test it against your scenario plans.

Lesson 3: Monitor, analyze, and act in real-time

Implement real-time monitoring and analysis across all relevant digital and media platforms and be prepared to address issues early and head-on if they materialize.

Lesson 4: Engage with your stakeholders’ digital platforms, not just your own

Companies are often less proactive in engaging with digital platforms that they choose not to use themselves, but that their stakeholders use frequently. (Reddit was an example of this phenomenon during the meme stock frenzy.) This means some social media activity can catch them unaware. Companies must still be active listeners on those platforms so that they are aware of issues and can respond appropriately.

Lesson 5: Articulate and back up your strategy

Companies must articulate a forward-looking strategy grounded in fact. Reassurance without basis or leaning too much on a track record may not convince stakeholders that you have a path forward.

Lesson 6: Understand when not to comment

Unless you are specifically targeted, don’t feel the need to say too much and attract excessive attention if developments at your organization are in line with or an improvement in the sector.

Lesson 7: Calibrate your policy response

In an industry crisis, most companies should work with industry bodies privately on a collective policy response and let those bodies articulate it. This tends to be more convincing than organizations speaking out on their own and allows companies to have cleaner public relations with policymakers. The exception is if the organization, or a smaller group of organizations, represents a dominant force in its sector and

needs to participate in or shape the solution more explicitly, or has an opportunity to do so.

Download a copy of the full article here.