Initial support among fans holds an edge, with 43% optimistic about the benefits of private investment and 29% opposed, according to a Brunswick survey. Sentiment dims when concerns are raised about the ways investors will turn a profit, the survey found.

“Stakeholders including fans will want to know how a school will protect its values,” explains Michael Schoenfeld, Partner and Co-Lead of Brunswick's Foundations, Education and Global Health practices. “They are going to be concerned about how private equity investors will make money and what impact that may have on the university.”

The challenge for the leaders of private equity firms and universities contemplating a deal will be to come up with an arrangement that will be easy for fans to understand and won’t set off a public backlash against the school or the investment firm, adds Alex Yankus, Partner and Financial Institutions Group Global Lead for Brunswick.

Selling a financial interest in a college athletic program will get a lot of media coverage, and getting on the wrong side of fans could cause reputational harm for both sides unless the structure of the deal and the messaging address the concerns of fervent supporters, cautions Yankus, who is a longtime advisor to leading global private equity and private credit firms.

“There is meaningful risk associated with the fact that these are community assets that people have a lot of pride in,” Yankus points out.

Colleges need to find new sources of revenue to cover the costs of the settlement, which will shift billions of dollars from the schools to their student athletes if approved by the court. It requires $2.78 billion in damages to be paid over 10 years to former student athletes who were not compensated for the use of their name, image or likeness (NIL) and sets up a framework for sharing as much as $2 billion a year going forward.

“The financial pressure on schools is very real,” Schoenfeld says.

Some schools will look to private equity or private credit platforms, which could not only supply fresh capital, but also provide their business acumen and expertise to identify opportunities to generate more revenue or operate more efficiently.

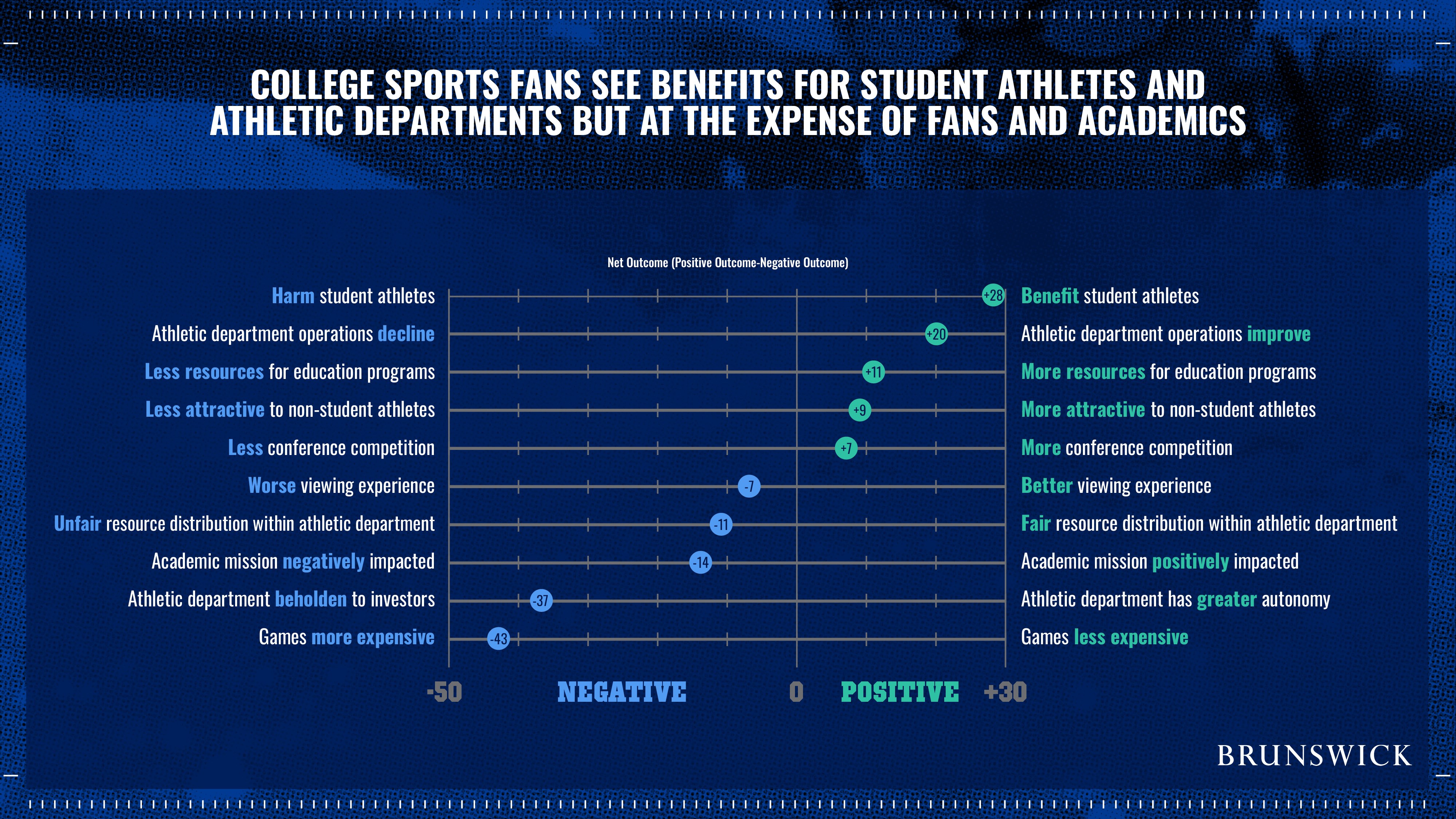

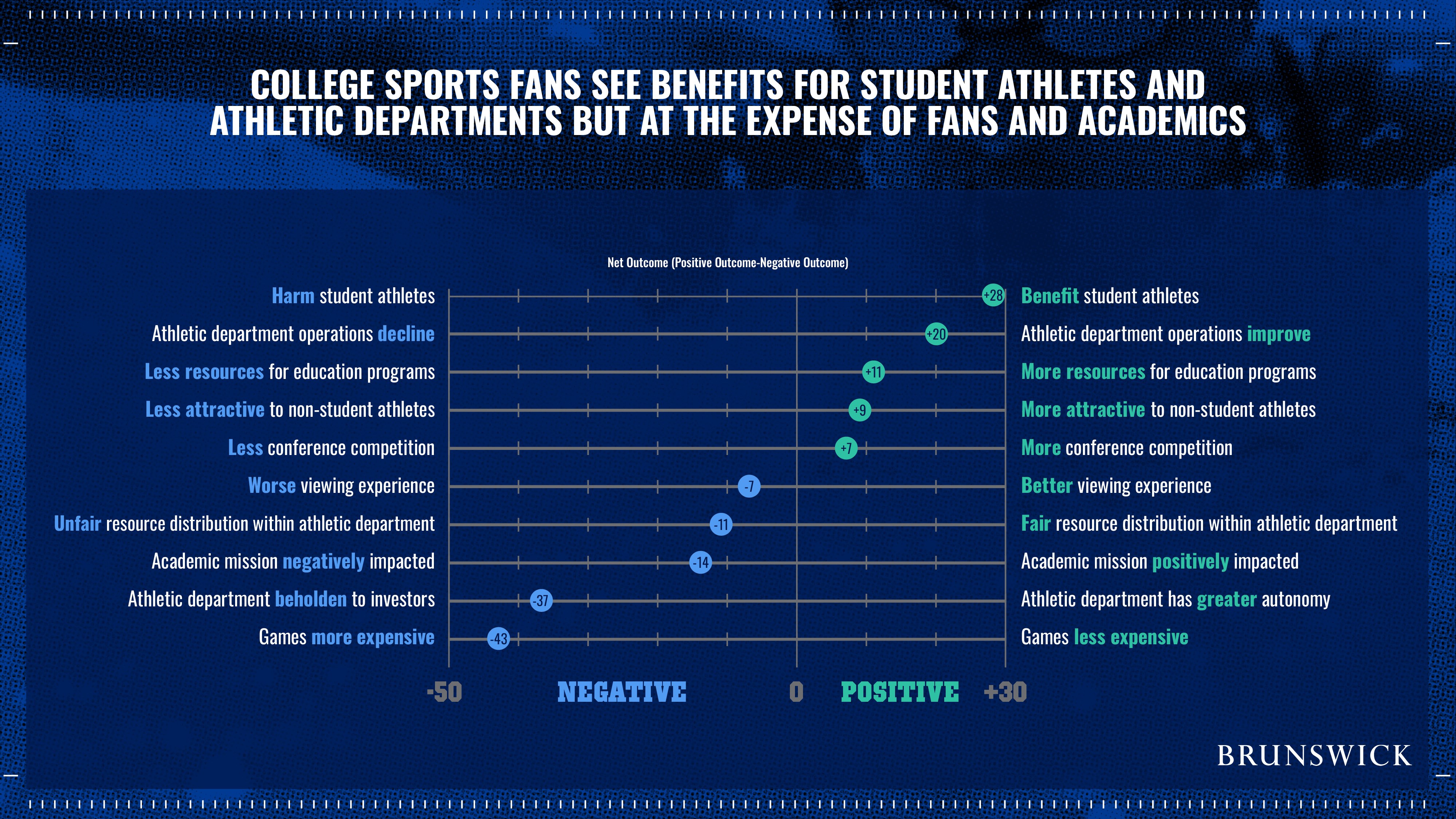

Fans generally recognize the need for funds to pay student athletes and improve athletic facilities, but many are concerned that investors will want to push up ticket prices and may pressure schools to prioritize sports over academics, according to Brunswick’s survey.

Fans also worry about the gap widening between big schools with powerhouse football and basketball programs and smaller colleges that may not be able to attract investors.

Leaders from higher education and private equity funds will need to proactively communicate about how a deal would benefit the whole school and the broader community.

Providing more scholarships to students who aren’t athletes and freeing up resources for education programs, infrastructure improvements and other non-sports priorities are other ways to win over fans, Brunswick’s survey found.

“For universities, the key message needs to be that every dollar they don’t have to spend on sports is a dollar that will be spent on academics, scholarships, faculty or research,” says Schoenfeld, who previously served as chief communications and government relations officer for two universities in the Power Four group.

Background on House v. NCAA Settlement

In the House v. NCAA case, former student athletes challenged the National Collegiate Athletics Association’s ban on payments to student athletes for the use of their name, image and likeness. A settlement was reached in May that, if approved by the court, will provide $2.78 billion in damages over 10 years to current and former Division I athletes.

The settlement also sets the stage for the NCAA to move to a revenue-sharing model that would generate financial benefits for college athletes starting as soon as next year. The NCAA estimates that the new model could provide up to $2 billion annually to student athletes in the Atlantic Coast Conference, Big Ten Conference, Big 12 Conference, Pac-12 Conference and Southeastern Conference, as well as other Division I schools that choose to participate.

This change opens the door to outside investment as college athletic departments and NCAA conferences move to a model similar to that of professional sports leagues, requiring increased capital and new revenue streams. Large investment firms, including both private equity and private credit funds, are now assessing potential opportunities to partner with these programs.

Survey Methodology

Brunswick Group conducted an online survey July 2-9, 2024, among 600 self-described engaged college sports fans in the U.S., with a margin of error +4.0% in 95 of 100 cases. The respondents were adults who have a bachelor’s degree or higher, are fans of college sports and are engaged, defined as regularly viewing college sports, following sports news, having played a college sport or are the parent of a college or high school athlete.

You can download a copy of this note here.