While slow to follow the US lead, international markets are taking notice

Shareholder activism remains largely a US phenomenon, where it is associated with big hedge funds and larger-than-life personalities calling for stock buybacks or increased dividends. While these high-profile campaigns can lift share value, they are often criticized as focusing heavily on short-term financial gains to the detriment of long-term interests and the broader needs of all stakeholders, including employees, customers and the surrounding community.

Elsewhere in the world, however, “shareholder activism” can mean something very different and workers and the community are put first as pressures are brought to bear on companies to change corporate or social behavior. Concerns for the environment, human rights and politics have been effectively aired through such activist shareholder campaigns.

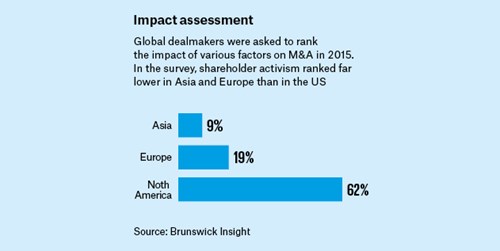

Investor campaigns for social change in the US are common but are overshadowed by the big money at play in the hedge fund variety. Meanwhile, the US experience of shareholder activism, while it has so far failed to take root in most other countries, remains a growing influence, and is helping reshape corporate structure and financial markets across the globe.

- Europe - Time to brace for activist surge

- Asia - Cue for more engagement

- Japan - Abe’s reforms open a door

- India - Minority stakes gain a new voice

- South Africa - Investors press for social change